NYCB Radar

2020.09.05 14:02

뉴저지 최재호 변호사 서류위조로 PPP 9백만불 받아 체포

조회 수 5457 댓글 0

뉴저지 최재호 변호사 서류위조로 PPP 9백만불 받아 체포

유령회사 3곳 설립...크레스킬 100만달러 저택 구입

260만 달러 부인 명의 주식(아마존, 테슬라, 애플 등) 투자

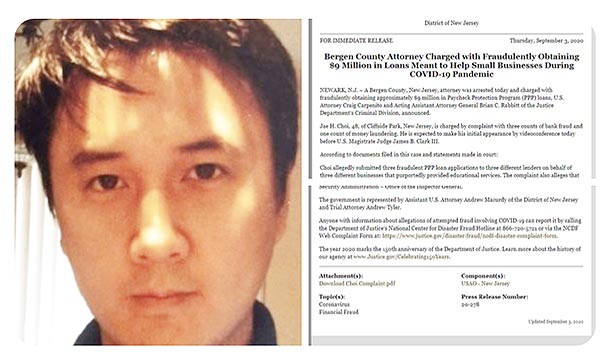

Jae H. Choi, 48, New Jersey Attorney Charged with Fraudulently Obtaining $9 Million in Loans Meant to Help Small Businesses During COVID-19 Pandemic

https://twitter.com/AnonCassi/status/1301909990492561413?s=03

뉴저지 클리프사이드파크에 사는 한인 변호사 최재호(Jae H. Choi, 48)씨가 3개의 유령회사를 만들어 불법으로 900만 달러의 PPP(급여보호프로그램)를 대출받아 금융사기 3건, 돈세탁 1건 등의 혐의로 연방검찰에 체포됐다.

최재호 변호사는 교육 서비스를 제공하는 사업체 3곳(스마트 러닝/홈스쿨바이어스클럽/에듀클라우드)을 운영하며, 수백명(170+182+167=519명)의 직원과 계약자가 있는 것으로 은행거래, 세금 납부 기록, 신분증 등 서류를 위조해 올 4월 300만 달러씩 3건의 PPP 대출을 신청했다.

검찰에 따르면, 최재호 변호사는 PPP를 뉴저지 크레스킬에 있는 100만 달러 규모 주택을 구입하고, 부인 명의로 260만 달러를 아마존, 테슬라, 애플 등 주식에 투자한 것으로 밝혀졌다.

Count Approximate

1 April 3, 2020 CHOI submitted an application on behalf of Smart Learning Inc. to Lender 1 for approximately $3,077,300.00 in PPP funds.

(The PPP application submitted to Lender 1 stated that Smart Learning’s average monthly payroll was $1,230,925 and that the company had 170 employees.)

2 April 10, 2020 CHOI submitted an application on behalf of The Homeschool Buyers Club Inc. to Lender 2 for approximately $2,990,957.50 in PPP funds.

*Individual 1 was CHOI’s spouse and was a resident of Cliffside Park, New Jersey.

(As part of the application, CHOI provided social security numbers and names for 182 employees.)

3 April 23, 2020 CHOI submitted an application on behalf of Educloud Inc. to Lender 3 for approximately $2,903,200 in PPP funds.

*Individual 2 was CHOI’s brother.

(As part of the application, CHOI provided social security numbers and names for 167 contractors, along with other information. According to SSA records, only one of those individuals’ names matched the social security numbers provided.)

https://www.justice.gov/usao-nj/press-release/file/1312901/download

PPP loans, as follows:

i. Smart Learning Inc. (“Smart Learning”) is a Delaware Corporation, which purports to provide educational services.

ii. The Homeschool Buyers Club Inc. (“Homeschool Buyers Club”) is a California Corporation, which purports to provide curriculums for homeschooling.

iii. Educloud Inc. (“Educloud”) is a New Jersey Corporation, which purports to provide educational services.

*Approximately $2.6 million in the Investment Account was then invested in various stocks, including Amazon, Tesla, and Apple.

900만달러 PPP 불법대출 한인변호사 전격체포

http://m.koreatimes.com/article/20200904/1326951

가짜 서류 만들어 PPP 900만불 '꿀꺽'

http://m.ny.koreadaily.com/news/read.asp?art_id=8628948

Attorney took $9M meant to help small businesses hurt by COVID-19, authorities say

https://www.msn.com/en-us/money/smallbusiness/attorney-took-dollar9m-meant-to-help-small-businesses-hurt-by-covid-19-authorities-say/ar-BB18GWiZ

최재호변호사

Jae H. Choi, 48, a licensed attorney of Cliffside Park, New Jersey

Department of Justice

U.S. Attorney’s Office

District of New Jersey

Bergen County Attorney Charged with Fraudulently Obtaining $9 Million in Loans Meant to Help Small Businesses During COVID-19 Pandemic

NEWARK, N.J. – A Bergen County, New Jersey, attorney was arrested today and charged with fraudulently obtaining approximately $9 million in Paycheck Protection Program (PPP) loans, U.S. Attorney Craig Carpenito and Acting Assistant Attorney General Brian C. Rabbitt of the Justice Department’s Criminal Division, announced.

Jae H. Choi, 48, of Cliffside Park, New Jersey, is charged by complaint with three counts of bank fraud and one count of money laundering. He is expected to make his initial appearance by videoconference today before U.S. Magistrate Judge James B. Clark III.

According to documents filed in this case and statements made in court:

Choi allegedly submitted three fraudulent PPP loan applications to three different lenders on behalf of three different businesses that purportedly provided educational services. The complaint also alleges that Choi fabricated the existence of hundreds of employees, manipulated bank and tax records, and falsified a driver’s license on the applications.

Choi allegedly falsely represented to the lenders that the companies controlled by him had hundreds of employees and paid over $3 million in monthly wages. Based on Choi’s alleged misrepresentations, each lender funded each of the three businesses with an approximately $3 million PPP loan. As a result, the complaint alleges that Choi received a total of nearly $9 million in federal COVID-19 emergency relief funds meant for distressed small businesses.

Choi allegedly used the fraudulently obtained PPP loan proceeds to pay for numerous personal expenses, including to buy, among other things, a nearly $1 million home in Cresskill, New Jersey, to fund approximately $30,000 in remodeling and other improvements, and to invest millions more in the stock market through an account held in the name of his spouse.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act is a federal law enacted March 29. It is designed to provide emergency financial assistance to millions of Americans who are suffering the economic effects resulting from the COVID-19 pandemic. One source of relief provided by the CARES Act is the authorization of up to $349 billion in forgivable loans to small businesses for job retention and certain other expenses through the PPP. In April 2020, Congress authorized over $300 billion in additional PPP funding.

The PPP allows qualifying small businesses and other organizations to receive loans with a maturity of two years and an interest rate of 1 percent. Businesses must use PPP loan proceeds for payroll costs, interest on mortgages, rent and utilities. The PPP allows the interest and principal to be forgiven if businesses spend the proceeds on these expenses within a set time period and use at least a certain percentage of the loan towards payroll expenses.

The charges and allegations in the complaint are merely allegations, and the defendant is presumed innocent unless and until proven guilty in a court of law.

This case was investigated by IRS – Criminal Investigation, under the direction of Special Agent in Charge Michael Montanez; inspectors of the U.S. Postal Inspection Service, under the direction of Inspector in Charge James Buthorn; the Small Business Administration Office of the Inspector General; and the Social Security Administration – Office of the Inspector General.

The government is represented by Assistant U.S. Attorney Andrew Macurdy of the District of New Jersey and Trial Attorney Andrew Tyler.

Anyone with information about allegations of attempted fraud involving COVID-19 can report it by calling the Department of Justice’s National Center for Disaster Fraud Hotline at 866-720-5721 or via the NCDF Web Complaint Form at: https://www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form.

The year 2020 marks the 150th anniversary of the Department of Justice. Learn more about the history of our agency at www.Justice.gov/Celebrating150Years.

https://www.justice.gov/usao-nj/pr/bergen-county-attorney-charged-fraudulently-obtaining-9-million-loans-meant-help-small